As a financial guy I believe overspending and insufficient savings are the cause of too much unneccessary pain. I have decided to deviate from my normal Excel Posts for what I believe can be a life changing discpline to adopt. I call it 10 Steps to Build Your Freedom Nest Egg. it is a post borrowed from my other site: Thoughtful Living in a Complex World

If you are reading this blog post chances are you have either decided to get off the earn and spend treadmill or are looking for positive reinforcement on your ongoing journey to Build Your Freedom Nest Egg. Either way welcome and congratulations you have started on a journey that can alter your future in some wonderful and unpredictable ways. I say unpredictable because freedom from debt and being FI (Financially Independent) opens all kinds of opportunities.

“Many people take no care of their money till they come nearly to the end of it, and others do just the same with their time.” —Johann Wolfgang von Goethe

Ask yourself what kind of life do I want to lead? Do you want to be a slave to chasing the acquisition of ever more stuff? Or do you want to simplify your life and be in charge and minimize stress? Having lived in a home where we feared the next unexpected event like the Dentist, the Doctor, tires for the jalopy, etc., I can tell you stress and that feeling of not being in control is no way to live. The alternative I am proposing is having You Freedom Nest Egg large enough to cover 99% of whatever curveball life throws your way – and I can attest life on the ‘Pile’ is simply awesome.

“You must gain control over your money or the lack of it will forever control you.” —Dave Ramsey

I am here to suggest several practices you can adopt to help you build that pile. It worked for us and it can work for you. A foreword though, my wife and I are diligent savers, you might not want to give up you morning Dunkin or Starbucks or your situation might prohibit you from adopting some of these steps, that is fine, if you follow rule #1. and find savings elsewhere and you will succeed. My goal is to inspire you.

A word about balance and living a good life. We still managed to go on a vacation each year. It is all a trade-off as the size and speed of growth of that ‘do anything pile’ is all up to you. Simply put your choices have consequences.

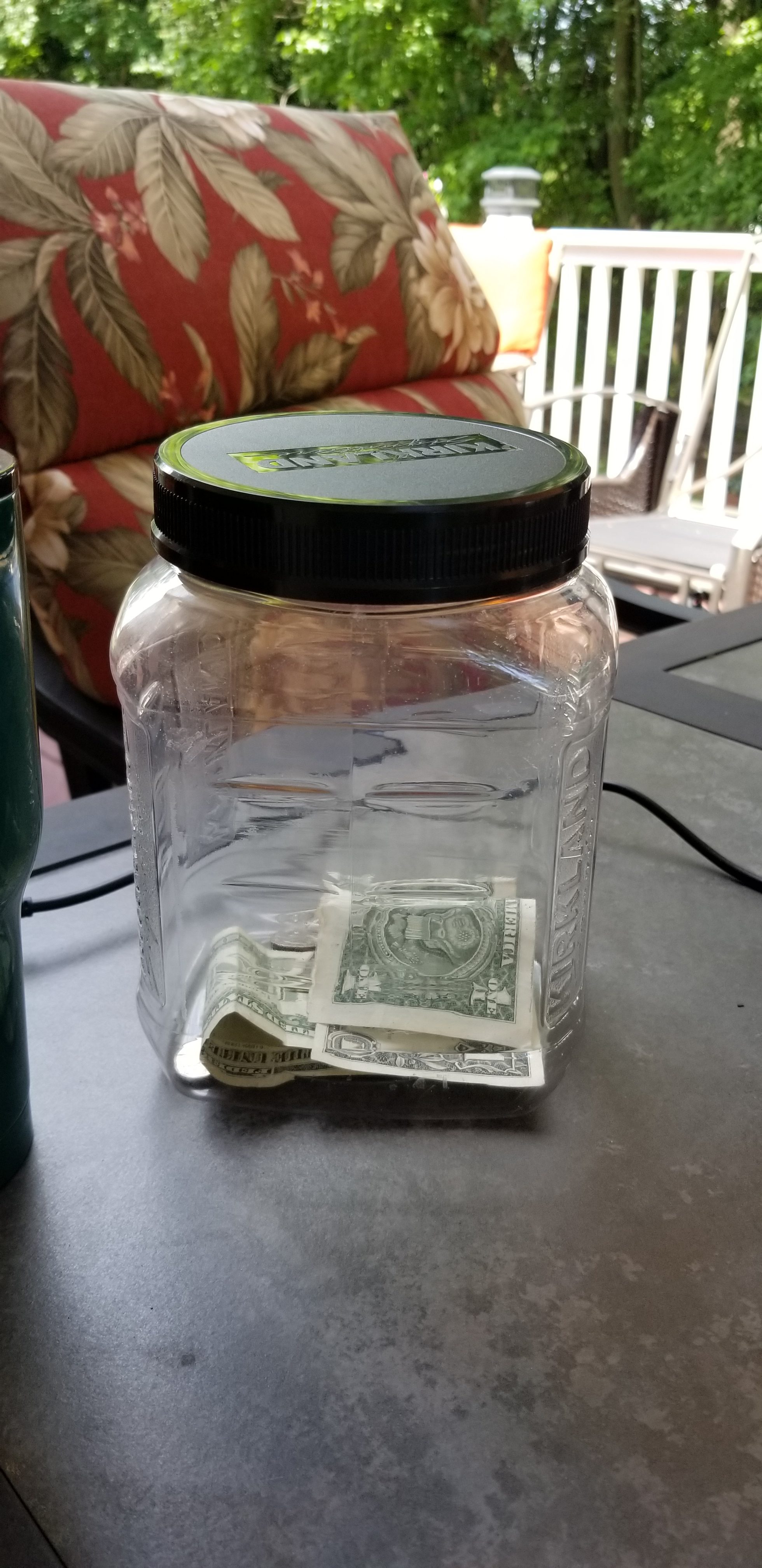

See the jar to the left it has $3.39 one days savings from foregoing the Dunkin latte. Now visualize that jar with $840 a whole year of savings. Savings/Money can be a bit abstract but, a jar full of money is pretty easy to understand.

10 Steps to build Your Freedom Nest Egg

1. Save First

Sign up for that automatic savings. Nothing can be as powerful as this because it does the work for you and most people manage their finances to what is in your checking account. You know the old saying out of sight out of mind.

My colleague and buddy Greg had a new baby and a wife not working. He decided he could not afford to contribute to the 401K plan at work. I knew forgoing the 5% company match was a big mistake. Fast forward a few years and I showed him my statement. “How did you get so much in there?” Answer: automatic savings plan, compounding, and the company match. Oh, that suggests a fundamental rule:

Never leave free money on the table.

2. Brown Bag Your Life

This means never pay for what you can reasonably do for yourself. A rather famous or infamous example is “The latte effect”. I am a big coffee drinker, plain old joe with a little skim milk. When I get up, I will relax and read with a big cup at my side. Then go for my daily exercise walk for about an hour. The end of that walk takes me past Dunkin Donuts and since it usually Rush hour when I pass there it is busy. Why? Is their coffee superb and not duplicatable? No, it is the convenience of drive up and get your coffee handed to you. It comes at quite a cost though. Look at the picture I snapped of the drive-up menu. A medium Latte cost $3.79 My home brew cost me maybe 40 cents a cup at most. – That is $3.39 a day difference. $3.39 five days a week is 16.95 a week or roughly $70. a month. or roughly $840 a year. After 5 years if you invest the money in the market and it grows @ 8% per year you have over $5,100. Clearly it adds up.

Look at the picture I snapped of the drive-up menu. A medium Latte cost $3.79 My home brew cost me maybe 40 cents a cup at most. – That is $3.39 a day difference. $3.39 five days a week is 16.95 a week or roughly $70. a month. or roughly $840 a year.

if you invest the money in the market and it grows @ 8% per year you have over $5,100. Clearly it adds up.

“It’s not how much money you make, but how much money you keep, how hard it works for you, and how many generations you keep it for.” —Robert Kiyosaki3. Invest and take some risk

Saving without investing and taking some risk will not get you that pile. Lucille, also a colleague, had been saving for years in the 401k, taking full advantage of the company match. We got to chatting regularly and I learned Lucille had experienced some difficult times in her life, divorce then her ex-husband and alimony provider died shortly thereafter. Understandably she was pretty risk adverse and as a result she invested her 401k in what was then called the D fund. Very safe but of course low returns earning not much more than inflation. I was always very optimistic on long term investing in equities. My enthusiasm was contagious and frankly I persuaded her to take some risk and she bought an equities fund. Fast forward a few years at her retirement luncheon. She came by and said, “Ray if it was not for you, I wouldn’t have anything.” Remember investing is for the long haul you need to take risk if you want to maximize the growth over time.

Saving alone will not get you to that stress insulating pile.

4. DIY

I am a reasonably handy guy: I worked in a plumbing supply store during my community college days. I am comfortable replacing sinks, toilets, and most things ‘plumbing’. The Mrs. is a very good, fussy, patient painter of the house interior. The driveway needs to be sealed the Mrs. does it. Even before there was YouTube, we always were big DIYers. YouTube is a DIYers dream – Have a runny toilet? search YouTube there will be someone to show you how to fix it. The point is that $100 you do not hand the plumber today could be in your brokerage account working for you- earning dividends, growing, and building your pile. We never called a service person for what we could reasonably do ourselves.

5. Always buy less than you can afford.

I will admit but this is a difficult one to put into practice but once mastered you will reap huge benefits. I am going to use cars as an example because it is a big-ticket purchase that many people get wrong. You have graduated, got that first job and your “Junker” is finally too far gone to be worth fixing. Simply put you need a new set of “wheels”. So, what do you do?

a. Go to the dealer and buy some fancy, loaded Zoom Zoom?

b. Buy a 3-year-old Toyota Corolla

I was there eons ago I bought a 7-year-old, unappealing green, 4 door Corolla. It was super reliable, easy on gas, insurance, the wallet and more than enough for my couple mile commute. Many of my friends and colleagues went to the dealer and bought too much car and paid and paid and then paid some more. Those cars are long gone but the painful lessons remain. Google the expressions “Car Poor” or “House Poor” and learn.

6. Think of debt as a disease.

I have a confession to make I worked for JPMorgan’s credit card division for my last few years with the firm. What I learned was Credit Cards are like financial quicksand for all too many people. There will be people that will tout the convenience of credit cards, the points, the cash back, the miles and the safety but, do not be fooled, credit cards are a scourge.

Let us look at some telling facts:

· 47% of Americans are carrying credit card debt, according to a survey from CreditCards.com.

· Up to 40% of Americans cannot pay more than the minimum.

· For those households who carry balances the average balance is $9,333

With an average credit card interest rate of 16% That $9,300 is costing $1,488 every year.

Car loans, Credit Cards, Personal Loans are to be avoided, where possible, like the plague.

7. Build a budget

The process of building a budget serves more than just providing a steerage map for your money. It is a critical review of where your money is going. I suggest you get your checkbook and credit card statements together and use a spreadsheet to detail each expense by month. So, if you pay $222 a month to Verizon for phone and internet that becomes a line item under the entertainment category. Be as detailed as possible. I will bet you are going to make some real and unpleasant discoveries. THink of them as budget leaks. That is ok, maybe you will discover that you are getting takeout far too often. Great, that is actionable, Plug that leak and now simply cut down on the take outs.

You can download my free Excel yourself Budget Tool HERE

8. Coupon and sale shop

The Mrs. has a coupon folder in her bag that she keeps up to date. She also monitors digital coupons in the weekly ads and adds them to the appropriate Supermarket App. She just showed a $1.00 off ShopRite digital coupon for Cheerios (a staple in my house). She will check the after sales per ounce cost against other stores. If the price checks out, I guarantee our next visit to ShopRite will include a couple of those yellow boxes. Those coupons add to significant savings!

A few years back I found an 8 by 12 greenhouse that I decided to treat myself too. I enjoy vegetable gardening. Before I could press the buy button the Mrs. searched the internet and found a $100 off coupon. Like I said, we always shop for sales and coupons to great effect.

9. Save windfalls

At some time or another you may find yourself in a position where extra money comes your way- tax return, overtime, inheritance, bonus, etc., Unless you have a real need save at least 80%. You heard me 80%. I was fortunate to be in a job where bonuses were the norm. Each year we would buy ourselves a little something and have a special meal to celebrate. Usually every penny went to savings unless the house needed something.

“A simple fact that is hard to learn is that the time to save money is when you have some” —Joe Moore

10. Learn the difference between needs and wants

A need is something that is necessary for the survival of a person.

A want indicates something that a person wishes or desires to possess.

“The quickest way to double your money is to fold it in half and put it in your back pocket.” —Will Rogers

I am not advocating you take on a monk’s lifestyle, but I think you need to be aware of the difference between nice to have and need. It would be nice to have a Rolex I guess, but does my 30-dollar Timex do the job? Does that Rolex provide some special functionality that I need? The answers to these questions are Yes and No.

A couple other thoughts

- Successfully Saving is a deliberate, non-passive activity that you need to work at. Automatic savings can help but you still need to be mindful of how you spend your money.

- There will always be setbacks to saving and investing, perseverance and tenacity are the keys that will get you through those challenges.

- The sooner you start the better

If you have a challenge with Excel, Access or Word and would like to speak with Ray, You can get his contact details by clicking here: Contact Me