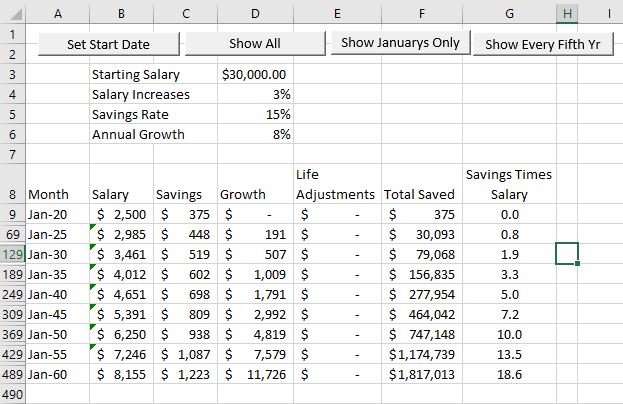

The spreadsheet I call My Savings Life was developed to keep your savings plan simple. I had been pondering about what % of your income do you need to save to get to that magic 20 times your spending. It turns out if you save 15%, earn 8% in 40 years you will have equal to roughly 20 times your salary.

Do you say you want to retire early? You have a couple of choices:

1) Spend less in retirement

2) Save More

3) Earn more on your money.

I will discuss each of these below, first, let’s talk about the spreadsheet.

First, I think the great thing about looking at Your Savings Life is that reminds us that the savings or accumulation phase of our life is limited. If you play with the numbers you quickly learn saving more earlier has the biggest impact. That is the magic of compounding. if you put a single dollar into the life adjustments that very first month you will have 23 more dollars at retirement.

Assumptions

Salary Increases 3% – This is a tuff one, over my career I averaged a 6% growth rate. I think I was particularly lucky to work for a lucrative industry (Banking) in technology and getting a couple of graduate degrees. I did a little research and for the last few years, the average salary increase was 3%. I know this is conservative but in the end, saving 15% of the salary will get you to the goal of 20 times your earnings. Additionally, studies show salary growth happens early in careers.

Growth 8% (after Monthly Compounding) – My assumption is that you put your savings in a low-cost index fund like VTSAX, The Vanguard Total Stock Market Index Fund. Over the past 140 years, U.S. stocks averaged 10-year returns of 9.2%, Goldman said. The worst decade was the 1930s, which delivered an average annual return of negative 4%, while the best was the 1950s, which returned 21% a year. 8% seems is conservative over 40 years.

Retire Early?

The math is simple: save more, reduce your expenses in retirement, or earn more on your savings.

n Earning more on your savings would involve more risk. Not a good idea when it comes to your life savings. VTSAX is a highly diversified mutual fund- the point of investing in it is diversification is a tool to minimize risk.

n Reducing expenses for many of us is possible but there are limits

n Increasing savings is an area where, in my opinion, most of us could more. I did some ‘noodling’ with the numbers each 2% you save more means 2 years less to reach that goal. Save 20% of your salary and you will reach your goal 5 years earlier. Save 25% and you will reach your goal in 30 years, retire at 53 Sweet!

Windfalls – It has been 5 years since you graduate and an: inheritance, property sale, gift, or even a tax return puts some money in your hands. You can either put it in investments or buy that shiny new car, truck, or toy. Pop that 20K into life adjustments and you will hit the magic number 20 months earlier.

Summary

Start saving now, do it automatically (a.k.a. Save First) If there is a 401K match take advantage of it. Invest your savings in low cost mutual funds. Brown bag your life and avoid toys (zoom zoom) and annuities (unused gym memberships, bloated cable subscriptions).

I do not think about what money can buy me; I think about money as a tool to avoid stress. For example, The jalopy needs an $800 set of tires- boom just do it and move on. When you reach financial independence and money is no longer a factor, life becomes simpler.

You can download a free copy of the My Savings Life Below.

If you enjoyed this post or found it helpful and would like to say hello and buy me a cup of coffee

Click here

Ray has said, “I love nothing better than using VBA to unleash the power of Microsoft Office.” You can contact Ray @ 484 574-3190 or by emailing him Here

If you have a challenge with Excel, Access, or Word and would like to speak with Ray, You can get his contact details by clicking here: Contact Me