Posted on by raymond Posted in ToolsTagged Business Daily checklist, Business maonthly checklist, Business weekly checklist

Daily Business Checklist and Diary App – Every Business has a list of things that need to get done if you are to stay in business and be successful. Those ‘checklists’ can vary widely and are bespoke to your individual business needs. For example, my Daily Business Checklist and Diary App starts with:

- Check website/blog for comments

- Review my Email

- Review website statistics and download log

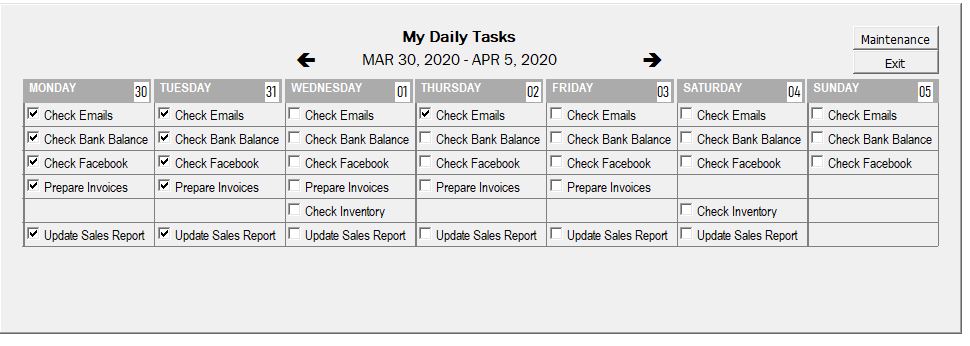

I did a little “net surfing” and I learned there are many Business Checklist Templates out there, but they are static and generic. [Example Here] For some businesses there will be critical items like reviewing inventory that has a limited shelf life. If you don’t have any raw materials your business might come to a standstill and customers will be disappointed. That could be detrimental to future business and that is disastrous. So, I wanted to build a Daily Business Checklist and Diary App where you can tailor to your business and that you can enter a daily diary of important tasks. The Daily Business Checklist and Diary App is what I came up with and it has three key components:

When you start the day, you know what has to be accomplished. Any unchecked items from yesterday are subject to your immediate investigation.

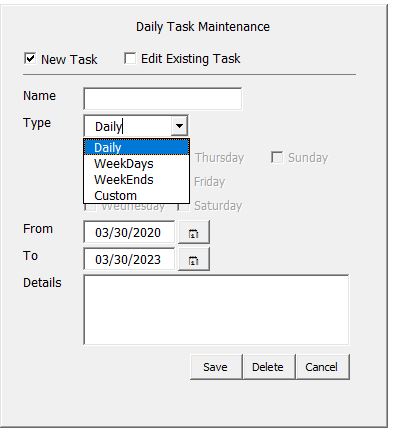

Daily Task Maintenance

This simple form will allow you to add (up to 15), edit and delete checklist.

1. Simply add a brief name.

2. Choose a frequency: Daily, Weekdays, Weekends and Custom allows for select specific days for each week. In our example above Inventory is done on Wednesdays and Saturdays.

3. Set a To and From date (some of your tasks may be seasonal).

4. Add a description

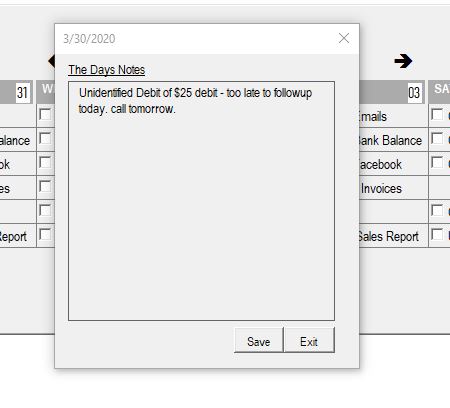

Daily Diary (click on shaded Day header)

In this example the user was checking the bank balance (2nd item on our example checklist) and noted a $25 dollar debit (charge). Since it was too late in the day to follow-up, he left a note in the Daily Diary for the next day. The app facilitates capturing key day events in a single retrievable repository. No “I left a note didn’t you see it?”

[sdm-squeeze-form id=1851 fancy="3" button_text="DownLoad Now"]

If you enjoyed my blog and would like to comment or share a similar experience please send your comments Here.

If you would like to say hello and Buy me a cup of coffee please follow the link

If you would like to say hello and Buy me a cup of coffee please follow the link

Raymond Mills, M.B.A., M.S. has spent over 20 years of his career as Accountant, Investment Bank and Credit Card Technical Auditor/ Data Analyst. His specialty was using Excel to get Big Databases including Teradata, Oracle, Squel Server and Sybase to give up their secrets.

Ray has said “I love nothing better than using VBA to unleash the power of Microsoft Office.” You can contact Ray @ 484 574-3190 or by emailing him Here

If you have a challenge with Excel, Access or Word and would like to speak with Ray, You can get his contact details by clicking here: Contact Me

If you have a challenge with Excel, Access or Word and would like to speak with Ray, You can get his contact details by clicking here: Contact Me